|

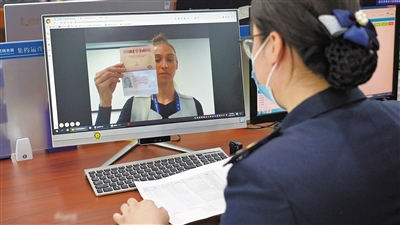

| Anastasia Antropova solves income tax queries in contactless way. (PHOTO: QIN RUIXUAN) |

On March 30, Russian Anastasia Antropova, who works in Hengqin Chimelong, Zhuhai city, as a dancer, made a video call with the staff of the Hengqin Tax Department through the V-Tax platform, completed her identity confirmation, and obtained her registration code on the Individual Income Tax APP.

Due to the impact of COVID-19, Antropova lived in China for more than 183 days in 2021 and is required to complete her individual income tax settlement in accordance with Chinese tax law. Like her, about three hundred foreign employees in Hengqin Chimelong hold foreign passports and need real name authentication before registering and logging in to the Tax APP.

The tax department of Hengqin took the initiative to contact relevant companies to enquire about the situation of foreign employees. Four centralized processing periods were then specially arranged to solve any problems they may have. Through online processing, hundreds of foreign employees completed the real-name authentication without leaving home, conducive to more efficient completion of subsequent processing procedures.

"As the construction of the Guangdong-Macao In-depth Cooperation Zone in Hengqin progresses, an increasing number of people from outside of Chinese Mainland are moving to Hengqin, a small island of Zhuhai city. Through research, we gain a better understanding of the management requirements of key industries, enterprises, and groups. We have developed appropriate plans for foreign nationals with special needs and established a 'non-contact' fast track for them to resolve individual income tax issues," said an official from the Cooperation Zone Tax Bureau.

To adapt to the measures taken for pandemic prevention and containment, the Hengqin tax department has taken the lead in realizing the "contactless" service for all businesses in the province, and all tax matters can be handled online with higher efficiency.