OLD INDUSTRIAL BASE OF HEILONGJIANG GETS DIGITAL MAKEOVER PAGE 2 | FOCUS

OLD INDUSTRIAL BASE OF HEILONGJIANG GETS DIGITAL MAKEOVER PAGE 2 | FOCUS XINJIANG SEEN REMARKABLE DEVELOPMENT: GLOBAL OBSERVERS PAGE 3 | INSIGHTS

XINJIANG SEEN REMARKABLE DEVELOPMENT: GLOBAL OBSERVERS PAGE 3 | INSIGHTS Wentian Brings More Scientific Experiment Opportunities

Wentian Brings More Scientific Experiment Opportunities 无标题

无标题 无标题

无标题 Industrial Economy Resilient in First Half

Industrial Economy Resilient in First Half 无标题

无标题 无标题

无标题 无标题

无标题 无标题

无标题 WEEKLY REVIEW

WEEKLY REVIEW 无标题

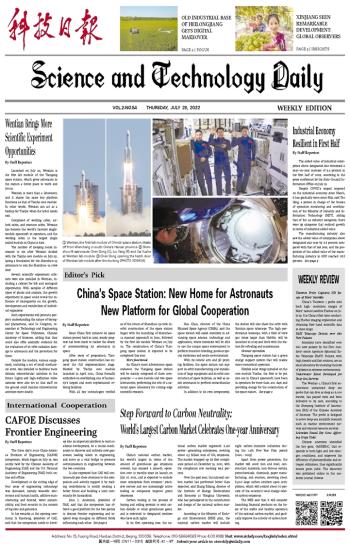

无标题 China's Space Station: New Home for Astronauts New Platform for Global Cooperation

China's Space Station: New Home for Astronauts New Platform for Global Cooperation 无标题

无标题 Step Forward to Carbon Neutrality: World's Largest Carbon Market Celebrates One-year Anniversary

Step Forward to Carbon Neutrality: World's Largest Carbon Market Celebrates One-year Anniversary CAFOE Discusses Frontier Engineering

CAFOE Discusses Frontier Engineering 无标题

无标题 无标题

无标题

China's national carbon market, the world's largest in terms of the amount of greenhouse gas emissions covered, has enjoyed a smooth operation over 12 months since its launch on July 16, 2021, and is expected to include more enterprises from emission -intensive sectors and see increasingly active trading as companies improve green awareness.

Carbon trading is the process of buying and selling permits to emit carbon dioxide or other greenhouse gases, and is restricted to designated emitters who have such rights.

In its first operating year, the national carbon market registered 2,162 power -generating enterprises, covering about 4.5 billion tons of CO_2 emissions. The market wrapped up its first compliance period on December 31, 2021, with the compliance rate reaching 99.5 percent.

Over the past year, the national carbon market has performed better than expected, said Zhang Xiliang, director of the Institute of Energy, Environment and Economy at Tsinghua University, who has participated in the construction and design of the national carbon market.

According to the Ministry of Ecology and Environment (MEE) plan, the national carbon market will include eight carbon-intensive industries during the 14th Five-Year Plan period (2021 - 2025).

Apart from power generation, the market will cover iron and steel, construction materials, non-ferrous metals, petrochemicals, chemicals, paper manufacturing, and aviation, involving about 8,500 large carbon emitters upon completion, which will control about 70 percent of the country's total energy-related carbon emissions.

The MEE said that it will consider launching financial products on the basis of the stable and healthy operation of the national carbon market, and gradually improve the activity of carbon trading.

Next

Next